All About Business Insurance Agent In Jefferson Ga

Wiki Article

Getting My Insurance Agency In Jefferson Ga To Work

Table of ContentsEverything about Life Insurance Agent In Jefferson GaNot known Incorrect Statements About Business Insurance Agent In Jefferson Ga Auto Insurance Agent In Jefferson Ga Things To Know Before You BuyThe Greatest Guide To Insurance Agent In Jefferson Ga

According to the Insurance Coverage Info Institute, the typical annual price for a car insurance plan in the United States in 2016 was $935. 80. On standard, a single head-on accident can cost hundreds of bucks in losses, so having a policy will cost much less than spending for the accident. Insurance policy also aids you avoid the decrease of your vehicle. The insurance safeguards you and helps you with cases that make against you in crashes. It likewise covers lawful prices. Some insurance policy firms provide a no-claim perk (NCB) in which qualified consumers can certify for every claim-free year. The NCB could be used as a discount rate on the costs, making cars and truck insurance more economical.

A number of elements affect the expenses: Age of the car: Oftentimes, an older car expenses less to guarantee compared to a more recent one. New automobiles have a higher market price, so they cost even more to fix or change. Components are easier to locate for older cars if repair services are needed. Make and design of lorry: Some lorries set you back even more to guarantee than others.

Threat of burglary. Specific lorries frequently make the frequently taken listings, so you could need to pay a greater costs if you have one of these. When it involves vehicle insurance policy, the 3 major kinds of plans are obligation, accident, and comprehensive. Compulsory obligation coverage spends for damages to one more driver's car.

The Definitive Guide to Home Insurance Agent In Jefferson Ga

Bike protection: This is a plan specifically for motorbikes due to the fact that automobile insurance coverage doesn't cover motorcycle accidents. The benefits of automobile insurance policy much surpass the dangers as you could end up paying thousands of dollars out-of-pocket for a crash you cause.It's generally better to have more protection than inadequate.

The Social Protection and Supplemental Protection Revenue impairment programs are the largest of a number of Government programs that provide aid to individuals with specials needs (Life Insurance Agent in Jefferson GA). While these two programs are various in many means, both are provided by the Social Protection Administration and just people who have a handicap and fulfill medical standards might get advantages under either program

A succeeding evaluation of employees' settlement claims and the degree to which absenteeism, morale and hiring excellent employees were problems at these companies reveals the favorable effects of providing medical insurance. When compared to companies that did not supply health and wellness insurance, it appears that providing FOCUS led to enhancements in the ability to hire good workers, reductions in the variety of employees' payment claims and decreases in the extent to which absenteeism and efficiency were troubles for FOCUS organizations.

Some Known Details About Life Insurance Agent In Jefferson Ga

6 records have been launched, including "Care Without Coverage: Insufficient, Far Too Late," which discovers that working-age Americans without medical insurance are much more most likely to obtain insufficient healthcare and get it far too late, be sicker and pass away quicker and receive poorer care when they are in the hospital, also for severe situations like an automobile accident.The research study writers also keep in mind that broadening insurance coverage would likely result in a boost in real resource cost (no matter who pays), because the without insurance receive regarding half as much clinical care as the privately insured. Health Matters released the research study online: "Just How Much Treatment Do the Without Insurance Use, and Who Pays For It? - Insurance Agency in Jefferson GA."

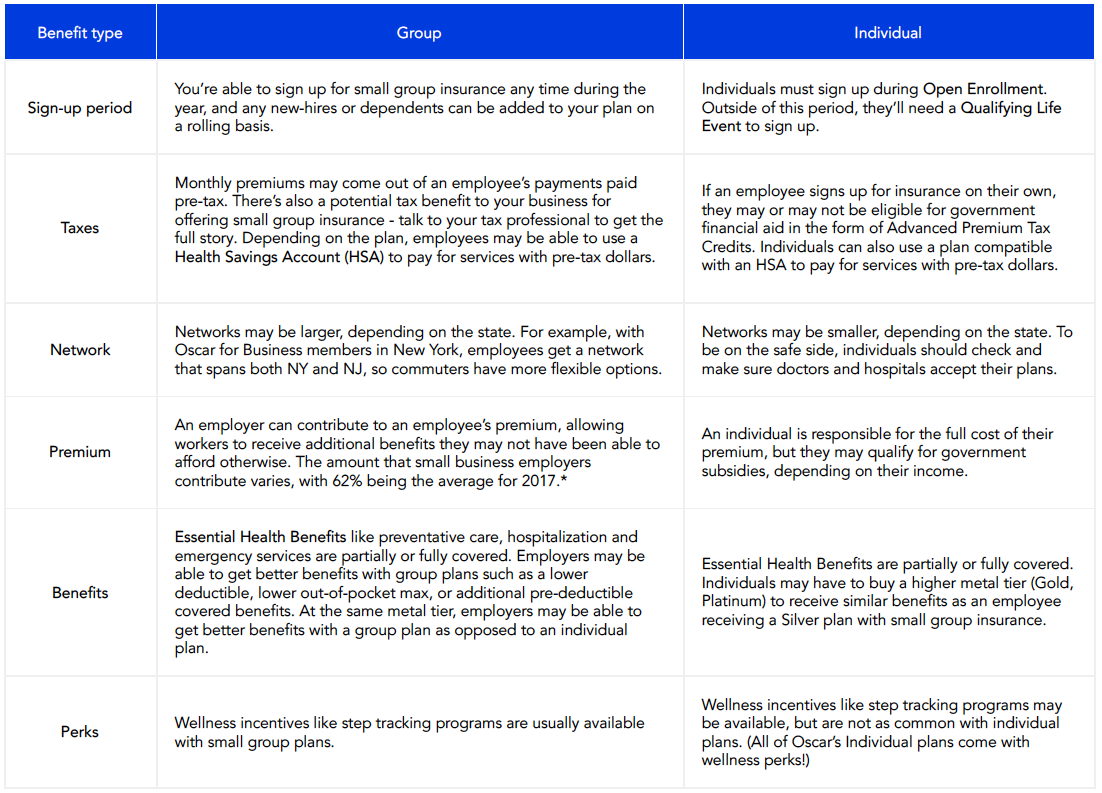

The responsibility of giving insurance for workers can be a challenging and often costly task and lots of little services think they can't manage it. What advantages or insurance do you lawfully require to supply?

10 Simple Techniques For Auto Insurance Agent In Jefferson Ga

Worker advantages usually begin with health insurance coverage and team term life insurance policy. As component of the health insurance coverage bundle, a company might choose to supply both vision and oral insurance coverage.

With the rising trend in the cost of medical insurance, it is sensible to ask staff members to pay a percentage of the insurance coverage. The majority of services do position the bulk of the cost on the worker when they provide accessibility to wellness insurance. A retirement (such as a 401k, easy strategy, SEP) is normally supplied as a worker advantage check out this site also - https://qualtricsxmy6mgkjvgp.qualtrics.com/jfe/form/SV_1X4bcnLEjDU6FqS.

Report this wiki page